| ATAA Blast! Newsletter #182 – August 2025

| Dear ~~first_name~~

Welcome to the latest edition of the ATAA Blast! Newsletter, with very useful and informative news, and based on some great feedback (in the recent National Office-bearers webinar) I have removed some of the extraneous material that has been lingering for a while. Hopefully this makes this Blast! News easier to skim through.

| In this Blast! edition you can see the following, with links for an easy and speedy go-to to the relevant section below:

- ATAA National President's Update for this month, and an Executive Summary from the recent board meeting, to help keep members informed of what the board has been doing.

- The latest ATAA Website Resource Library updates for the latest month.

- Online Discussion Forums - This resource is now growing in popularity in the ATAA website (for ATAA members only - login is required).

- ATAA National Board Update - News from the national board of directors.

- List of all of the ATAA Chapters, SIGs and Network Groups - More opportunities for the ATAA members for networking and learning.

- An update on the Trading Expert Series (formerly known as the National Speaker Series) of online presentations - the first one back in April with Brent Penfold was very successful, and the latest one with Gary Stone recently. The next one is coming up very soon - in early September. See details below.

- The ATAA 2025 In-Person Conference update - NOTE: Early Bird Registration (with discount) expires TODAY Friday 22 August! See a further update on the upcoming 2025 in-person ATAA Conference in Melbourne, 18-19 October, 2025.

- Updates from the ATAA Chapters and SIGs: Included below are updates for some Chapters and SIGs, noting that the Brisbane chapter is changing meeting details soon. Information below also includes the RealTest Coders Online Workshop, and some chapters: Canberra, Melbourne, Brisbane. Thank you to: Mark (Canberra) for your ongoing contributions.

- IFTA information update: Latest information from IFTA including details about the IFTA Conference in September.

- TECHNICAL ANALYSIS article - This month we include Part 2 of the topic addressing the question of: "What is Technical Analysis really?" Part 1 of this was included in the June edition of the Blast!

- Detailed benefits for ATAA members. Just in case you are missing something with your membership.

| I do hope you find this Blast! newsletter useful and interesting reading; but do feel free to tell us what you really think, and how we can improve it.

NOTES about this newsletter: The appearance of this email newsletter can be a little different depending on how you view it. In Google's Gmail the Gmail Inbox might show just a portion of this edition. At this stage I am not sure of the best way to work around this issue.

ps: Apologies continue for any odd formatting that you might find which I cannot resolve - font size or line spacing etc - as these seem to be oddities in our CE email editor tool (there are probably odd HTML codes hidden behind the text, which we have not found yet). Every month when I prepare this newsletter, I spend ridiculous amounts of time fiddling around trying to make the line spacing consistent throughout, and the font sizes consistent; but it still turns out less than I would want it to.

Robert B Brain

Blast! Newsletter Editor

ATAA Marketing Director

(and ATAA Life Member)

| Our Tag Line:

The ATAA is the knowledge network

for successful financial market

trading and investing

| ATAA Annual Conference, 18-19 October

Early Bird Discount Offer ends TODAY - Friday 22 August

|

From the President's Desk – August 2025

The ATAA is continuing to strengthen its marketing efforts, with three clear priorities:

- Encouraging new member sign-ups to support ongoing membership growth;

- Promoting registrations for the upcoming National Conference;

- Showcasing our Trading Expert Series — with the next event on 13 September, featuring Zoe Bollinger. This series is helping to raise the ATAA’s profile across the wider trading and investing community.

National Conference – Our National Conference in October is now just a couple of months away. Early-bird registrations close Friday 22 August, and I encourage all members - and non-members - to review the program and take part in this highlight of our annual calendar. More details below.

I would also like to remind members that the Board has approved a new initiative to encourage greater participation at the governance level: a 50% discount on ATAA membership and National Conference fees for active directors. This benefit applies both to current Board members and to any member who joins the Board before the Conference and contributes actively for at least six months.

Jim Haralambidis

ATAA National President

| Executive Summary – ATAA Board Meeting (5 August 2025)

At its August meeting, the ATAA Board reviewed progress on several fronts.

- Preparations for the October ATAA National Conference are advancing well, with most speakers confirmed, sponsors on board, and marketing underway to build registrations.

- Membership dipped slightly in July after several months of growth, and the Board is developing new initiatives to support continued improvement.

- Updates were received on recent and upcoming National Speaker events, and the date of the 2025 ATA AGM was set for Wednesday 12 November.

- The Board also agreed to recognise a key conference volunteer with a registration discount and to invite members to contribute to an academic research project on trading psychology.

We look forward to seeing members at our upcoming events and working together to make the rest of 2025 a strong and successful year for the ATAA. | Research Invitation – Share Your Experiences as a Trader

Former ATAA Board member Darryl Nagel is conducting a Master’s research project at Central Queensland University exploring the emotional experiences of retail traders. He is looking for traders who:

- Use a written trading plan and place orders manually;

- Use fully automated trading systems;

- Trade without a written plan.

Participation involves a short online survey and an optional 30-minute Zoom interview. All responses are confidential and anonymised.

Your input will help inform future education and support strategies for self-directed traders.

For more details, contact Darryl at darryl.nagel@cqumail.com. | ATAA Website Resource Library Updates - recordings July and August 2025

Our ATAA Resource Library now has many presentations and recordings going back to 2008. You can drill down on these using the website menu: Resources > Presentations by Date. An alternative way to find something specific on a particular topic is to search the library using the menu option: Resources > Search Resource Library.

The materials recently added to the Resource Library include:

- Thursday 14 August - Melbourne Chapter Hybrid meeting:

- Paul Ash - Technical Analysis for Investment - Chuck Hughes' Strategies.

- Alan McKay - Trading Techniques.

- Saturday 12 July - Online "Trading Expert Series":

- Gary Stone - Building Habits to Achieve Trading Excellence and Life-long Profitability.

- Thursday 10 July - Melbourne Chapter Hybrid meeting:

- Alan Clement - Global Markets Quarterly Technical Outlook.

- Karo Cornips - Using derivatives to leverage your view.

All of these items can be found from the ATAA website menu: Resources > Presentations by Date. Make sure to browse the earlier recordings in the Resource Library, because you might never know what you've been missing. And you can also search the Resource Library by keyword. If your local chapter or SIG has a video recording, or a (PowerPoint) slide deck of a recent session, then it can also be added to our library collection.

| |

ATAA National Board updates

| | | Trading Expert Series – Markets, Models and Mindsets | |

Zoë Bollinger presents:

"Building Technical Strategies for Offence and Defence"

Registration for this event is FREE for both ATAA members and non-members.

Saturday, 13 September 2025 — 12:15 PM AEST (Sydney / Melbourne / Brisbane Time).

Sign up NOW to receive the Zoom link and a recording of the presentation after the event.

| | | Join us for the next instalment of The Trading Expert Series on Saturday, 13 September 2025, featuring esteemed speaker Zoë Bollinger. This webinar will delve into the art of constructing technical strategies tailored for both aggressive growth and capital preservation.

Why You Can’t Miss This Event:

In today's dynamic financial landscape, mastering technical analysis is crucial for both capitalising on growth opportunities and safeguarding your investments. This webinar offers a unique opportunity to learn from Zoë Bollinger, a leading expert in the field, as she shares actionable strategies to enhance your portfolio's performance and resilience.

Event Details:

What You'll Learn:

- Offensive Strategies: Discover how to harness relative strength as a potent asset management tool. Zoë will guide you through the essential parameters and components required to build a successful relative strength portfolio, adaptable to various goals and risk tolerances.

- Defensive Strategies: Learn to utilise technical indicators, such as market breadth, to design portfolios focused on capital preservation. This approach aims to help investors achieve long-term objectives while mitigating volatility.

About the Speaker - Zoë Bollinger is the Vice President and Portfolio Manager at Bollinger Capital Management, where she collaborates with John Bollinger to develop and implement innovative investment offerings for clients. As a Certified Financial Planner™ professional, Zoë assists clients in achieving their long-term financial goals. She holds a Certificate in Financial Planning from the New York University School of Professional Studies and graduated summa cum laude from American University with a degree in International Relations, focusing on International Economic Policy. Zoë serves on the board of the International Federation of Technical Analysts (IFTA) and is an international speaker on technical analysis and investment management strategies.

Who Should Attend - This webinar is ideal for traders, investors, financial analysts, and anyone interested in enhancing their understanding of technical analysis strategies for both growth and risk management.

Registration - Secure your spot for this free webinar by registering below. Upon registration, you will receive a confirmation email with further details.

Date and Time - Saturday, 13 Sept 2025, 12:15 to 2:15 pm E. Australia Time (UTC+10:00)

|  | ATAA 2025 Annual Conference (In-Person and Online)

Saturday, Sunday October 18 and 19 |

“The Future of Trading – Blending Classic Tactics with Smart Technology”

Early Bird Discount Closing Friday 22 August

Conference: Saturday 18 - Sunday 19 October 2025, in Melbourne

We’re thrilled to announce this year’s highly anticipated ATAA National Conference, where trading meets innovation!

Whether you're an experienced trader or investor, or simply looking to sharpen your edge, this event is your opportunity to stay ahead of the curve in a rapidly evolving industry.

Why You Cannot Afford to Miss this Event:

- Expert Sessions: Gain invaluable insights from industry-leading trading specialists from both Australia and overseas over two packed days of learning.

- Actionable Strategies: Discover practical trading ideas, risk management tips, and how to leverage cutting-edge AI tools to boost your performance and profits.

- Unparalleled Networking: Connect with like-minded independent traders and industry professionals to expand your network and open new doors.

- Market Mastery: Learn strategies to navigate all market phases, especially during these uncertain times.

- Exclusive Gala Dinner: Socialise with speakers and fellow attendees in a relaxed, elegant setting.

- Premier Venue: Enjoy Melbourne’s vibrant central location, with discounted room rates available exclusively through conference registration.

The conference brings together industry experts, traders, and investors from across the country and around the globe to discuss the latest developments in the financial markets and share insights on trading strategies.

Join like-minded local and international technical professionals, traders, and investors for two days of learning, networking, and inspiration.

Don't miss our line-up of industry-leading speakers, including: Phil Anderson, David Bird, Michael Berman, Laurent Bernut, Richard Brennan, Cameron Buchanan, Michael McCarthy, and Kyle Potter. They'll share their expertise on: trading strategies, financial markets, trading psychology, and the latest developments in risk management.

Devote two uninterrupted days to your trading and investing goals. Immerse yourself in an environment free from distractions – allowing you to enhance your skills, expand your knowledge, and refine your strategies.

Join us in person or by livestream

Early Bird Discount Closing Friday 22 August

|

Members and non-members of ATAA equally welcome at this event. (Non-members will receive a complimentary 12-month ATAA membership as part of their registration package).

Two incredible days of learning, networking and inspiration. Let's shape the future of trading together!

In-Person Location: Mantra on Russell Hotel 222 Russell Street, Melbourne

Located in the Melbourne CBD between Little Bourke and Lonsdale Streets.

We recommend booking early. Early Bird rates are available and in-person capacity is limited!

Early Bird Closing on 22 August

| ATAA 2025 CONFERENCE GOLD SPONSORS | | MooMoo

Moomoo makes investing easier. Easy access to more than 26,000 stocks and ETFs in one powerful app. Open an account today to unlock exclusive welcome rewards.

Visit the Moomoo website. | | | | International Day Trading Academy

Learn day trading with a trading academy that supports your journey.

Watch the International Day Trading Academy web class for free and see how successful traders take advantage of the markets.

Visit the Academy website. | | | | Pepperstone

Established in 2010 in Melbourne, Australia, Pepperstone has grown to become an award-winning online global Margin FX and CFD broker known for delivering exceptional client service and withdrawals to tens of thousands of clients around the world.

For more information, visit: Pepperstone.com | | | CHAPTER and Special Interest Group (SIG) news and updates

| ATAA Chapters, SIGs and Network groups

For the benefit of ATAA members everywhere, the ATAA has a number of: Chapters, and Special Interest Groups, and Network Groups. Current financial members are free and welcome to participate in any of these. We are hopeful that all of these groups will submit some information for publication in the Blast! News from time to time, to help our hundreds of readers understand more about the opportunities and benefits for ATAA members.

For the latest meeting information, check the ATAA website for details, and also scroll down the website home page to see the latest announcements, presentations and updates to the resource library.

| | ATAA Chapters (alpha order) meeting monthly

- Adelaide

- Brisbane

- Canberra

- Melbourne

- Newcastle

- Perth

- Sydney

| | SIGs and Networks (and contact names)

- Melbourne Quant SIG (Jim Haralambidis)

- RealTest Coders (online) Workshop (Chris Meakin, Robert Grigg)

- Bigalow Network (Romy Baker)

- Forex Network - FN (Romy Baker)

- MetaStock Users SIG (Jerry Bongard)

- FX SIG (Mike Smith)

- TA Practice SIG

See the ATAA website for latest information.

| | | The Canberra Chapter enjoyed our sixth meeting of 2025 in July in the Board Room of Eastlake Football Club.

Chris continued with his excellent series on rules-based trading which continues to illuminate components of successful systems. Gabriel sent through an update of the portfolio competition which has participants with mixed results in the current market.

We held our second hybrid meeting of the year on July 15 with 11 local attendees and a guest, Claude, from the Sydney chapter. The presentation also attracted a healthy 15 online attendees. Shawn Hickman, research lead and director of Market Matters presented on the mix of technicals and fundamentals, seasonality, distribution theory and cycles and waves. Shawn invests for a large portfolio and provided many examples of macro positioning in equity markets.

Phil Johns is delivering our next hybrid meeting on Tuesday, August 19 in the Boardroom at Eastlake FC in Griffith at 6.00pm. In addition to our regular ASX review and portfolio competition, Chris Meakin will continue his series on Rules Based Trading.

Remember to bring your portfolio selection to our next meeting. If you would like to enter the portfolio competition and cannot make it to the meeting, send your selection to gabriel.spacca@ataa.asn.au.

If any ATAA member or guest would like to present at one of our meetings either online or in person, please send me an email me in the first instance and we can discuss your topic.

Good trading and good health.

Mark Gleeson

ATAA Canberra Chapter President

[The Canberra Chapter generally meets on the third Tuesday each month.]

| The Brisbane Chapter is changing its meeting time to a morning format. Starting on October 11th, meetings will be held from 9:00 a.m. to 12:00 noon while the frequency will remain on the second Saturday of the month. Each meeting will include a 15-minute networking break with tea, coffee, and light snacks provided.

Venue - All meetings will continue to be held at:

Lithuanian Cultural Association Hall, 49 Gladstone Road, Highgate Hill (corner of Morris Street).

The venue is conveniently located just outside Brisbane’s CBD:

- Free street parking is available on Gladstone Rd, Morris St, and Julia St.

- The no.196 bus from Adelaide St in the CBD stops right in front of the venue on Gladstone Rd.

- It is only a 15 minute walk from the Southbank bus and train stations.

The meeting room is air-conditioned and can comfortably seat at least 25 people at tables.

What to Expect - Meetings feature a variety of activities, including:

- Presentations and workshops focused on Technical Analysis Education

- Guest speakers sharing trading insights

- Networking opportunities to connect with other traders

- Discussions on trading ideas, strategies, and experiences.

One of the most valuable benefits of ATAA membership is the chance to network with like-minded traders, exchange ideas, and learn from each other in a supportive environment.

We hope this new meeting format will be more convenient and attract a larger audience. All are welcome.

For questions or more information, please contact:

Tim Young

ATAA Brisbane Chapter President

Mobile: 0414 873 003

[The Brisbane Chapter generally meets on the second Saturday each month.]

| | RealTest Coders online Workshop

| | |

Last month’s RealTest Coders workshop (operating under the Melb. Quant SIG) saw participants discussing how to data mine a large list of instruments. Scott demonstrated a method whereby each symbol was assigned a numeric value (in RT using Symbol=SymRef(SymNumber)), with optimization done on each of the values, the results pasted into MS Excel along with the list of instruments and numeric values, and XLOOKUP used to match results. This is an extension to the ‘For Each Symbol’ function in the Optimiser GUI and allows the optimizer to assess results when moving to a Cash equivalent (e.g. T-Bonds, Gold ETF, …) during market pullbacks.

This month’s meeting (to be held on Monday the 11th of August) will again be open discussion specifically aimed at RT coding.

The meetings are aimed at competent users of RealTest, but new users and intending users are more than welcome to join. A number of participants have also formed small ‘coding buddy’ groups (2-4 users) to develop and code up strategies collaboratively.

Recordings of the meetings along with any associated material can be found in the RT Coders SIG forum here.

| The Melbourne Chapter continues to host monthly hybrid meetings and we are still broadcasting the 2-hour segment of 6pm to 8pm by Zoom, and the recordings go into the ATAA website Resource Library - use the website menu: Resources > Presentations by Date. For those of you who are not able to be in the meeting room, you are missing: the invaluable networking (or "common gossip") from 5.15pm to 6pm (including free finger food), the interactions in the room during the broadcast session 6-8pm, and then further networking and guest speaker mingling over dinner after 8pm.

Don’t forget that public transport (tram) runs past the hotel front door, and there is ample car parking around the corner.

Robert Brain

ATAA Melb Chapter President and interim Secretary

(for the Council team: Paul Ash, Jim Haralambidis, Keith Mundy, Tony Hambling, Tony Leonard, Robert Grigg). | Sydney Chapter and

Bigalow Network and Forex Network (FN)

| Sydney Chapter - The Sydney Chapter meets monthly. See the event details on the ATAA website.

Looking forward to hearing from you.

Romy Baker

0414 554 967 | Don't forget, we have a total of seven chapters around Australia, including: Brisbane, Perth and Newcastle as well as several Special Interest Groups (SIGs) in which members can participate. You can see a list of the seven chapters and their office-bearers on the website - use the menu option: ATAA Overview > Current Office-Bearers > Chapter Councillors > Subcommittees. See the ATAA website for latest meeting and event details.

- Adelaide Chapter generally meets in-person on the third Wednesday of the month.

- Perth Chapter generally meets on the third Thursday of the month.

- Brisbane Chapter generally meets... second Saturday of the month.

- MetaStock Users SIG - Contact Jerry Bongard, jerry.bongard@ataa.asn.au

- RealTest Coders Workshop (sub-group of the Quant SIG) - Meets online, generally on the second Monday of each month at 8:00 pm. EST (to give members in western states a better chance of attending). SIG Coordinators: Chris Meakin and Robert Grigg.

| About IFTA (International Federation of Technical Analysis) - It is the umbrella organisation for Technical Analyst societies around the world.

IFTA webinars: See the latest information about up-coming and past webinars on the IFTA website. | IFTA 38th Annual Conference

Hosted by VTAD. 26-28 September, Frankfurt, Germany,

The Westin Grand Frankfurt.

Dear Participants, Colleagues, and Friends,

It is my great pleasure to welcome you to the IFTA 2025 Conference, where we gather once again to explore the latest advancements in technical analysis, market trends, and investment strategies. This year, we invite you to join us in an environment of innovation, knowledge, and global collaboration as we navigate the ever-evolving landscape of financial markets.

Under the theme “Exploring New Horizons in Technical Analysis”, we will delve into the transformative forces shaping our industry—from the role of artificial intelligence and algorithmic trading to the integration of behavioral finance and macroeconomic insights. As financial markets become increasingly complex and interconnected, our ability to adapt, analyze, and anticipate trends has never been more crucial.

The IFTA Conference is a platform for learning and a space for meaningful connections. Here, thought leaders, analysts, traders, and industry professionals exchange insights, challenge conventional wisdom, and inspire one another. Whether you are a seasoned expert or just beginning your journey in technical analysis, you will find invaluable ideas, strategies, and networking opportunities that will empower your professional growth.

I look forward to welcoming you in person, engaging in insightful discussions, and shaping the future of our field – together.

Best regards,

Wieland Arlt, CFTe

President & Conference Director 2025 | IFTA Update (Newsletter) - The June 2025 issue is now available.

The June 2025 issue of the IFTA Update is now available for you to download from here. (It's 18 pages and 6 megabytes - not large). In this issue:

- President's Report to Colleagues

- Member News

- 38th Annual IFTA Conference

- Congratulations New CFTes!

- Congratulations New MFTAs!

- New IFTA Website

- Thoughts About Elliott Wave

- NAAIM Founders Award

- IFTA Board of Director's Nomination Form

- and more

| IFTA and ATAA members - ATAA members are automatically affiliate members of the International Federation of Technical Analysts. ATAA membership gives you access to IFTA resources including: certification programs, educational events and networking opportunities, including participation in the IFTA Conferences. The information below is the latest update from IFTA.

IFTA Update (quarterly newsletter) - The IFTA Update is a quarterly newsletter that is available to members of the ATAA.

| The ATAA Elevator Pitch:

Join the ATAA to improve your understanding of how to

invest or trade successfully in the financial markets

focusing on the correct use and application of Technical Analysis

(if someone asks you what the ATAA does, simply tell them this) | |

TECHNICAL ANALYSIS

and Trading Tips

| | | Technical Analysis – What is it really? — Part 2 | In Part 1 of this article (in the June edition of the Blast! News) I wrote that Leon Wilson, in his book “The Business of Share Trading”, talks about primary analysis versus secondary analysis, where primary analysis is based on the study of the price charts (and volume) without including any chart indicators, and secondary analysis utilises any of the many available indicator tools. In Part 1 of this article in June I included introductory notes on the following:

- Technical Analysis Overview, and the diagram of the jig saw puzzle.

- Many novice traders are in search of the Holy Grail; but does it exist?

- Dow Theory - overview.

- Chart types (candles, bars, OHLC), with graphic examples.

- Chart periodicity (daily, weekly monthly, etc).

- Price Trends - uptrends, downtrends.

- Support and Resistance levels - what are they?

- Chart patterns.

- Candle patterns.

This month's Part 2 instalment, below, focuses on the secondary analysis and chart indicators, and contains some rather basic information – especially for those who are not yet well-equipped or skilled in technical analysis.

Secondary Analysis involves the use of various chart indicators. These tend to be classified into the following four categories:

- Trend indicators (eg. moving average, MMA, ADX, regression line, P-SAR)

- Volatility indicators (eg. Bollinger Bands, Average True Range)

- Momentum indicators (eg. RSI, MACD, Stochastic, ROC (rate of change), ADX/DMI, Coppock)

- Volume indicators (eg. OBV, volume oscillator).

When devising your own trading strategy, you might be tempted to look for a trading signal based on two indicators, such as one Moving Average (or a pair of Moving Averages), and also the ADX, for example. But because these are both “trend” indicators, they will tend to indicate the same results. It is best to select an indicator from two different categories, and look for confirmation across both categories. | Moving Average – One of the simplest chart indicators and which is in common use is the Moving Average. In the early days, before computers, the Simple Moving Average (SMA) would have been used; but these days the Exponential (EMA), or the Weighted Moving Average (WMA) are very popular because the computer can quickly do the calculations to show the result.

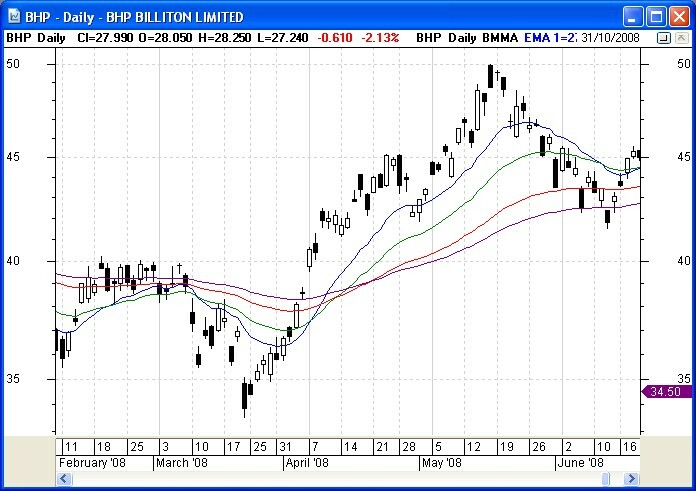

The sample chart below is a 21 “bar” (or 21 “period”) MA and indicates the average of all prices for the previous 21 price “bars” (ignoring non-trading days – weekends, holidays). It can be shown on a Daily chart, or Weekly, etc. The reference here to “bars” means the price action for one day, or for one week, or for one month, depending on which chart period you are looking at.

The sample chart here is a Weekly Line chart of BHP from January to August 2007, and shows a Simple Moving Average (SMA). Don’t forget that a weekly line chart simply shows the close price at the end of every week all joined together with a short straight line segment, and it gives no indication of the range in price during the week.

Across this chart we can see that the share price was trending up (Higher Peaks and Higher Troughs). The 21-week SMA shown in this chart (blue line) was falling at the start of the chart; but then turned up (confirming an uptrend), and it kept rising off the chart to the right.

|  |

Note the following key points about the Moving Average:

- Usually based on the Closing price.

- It’s common to use a Daily or Weekly period chart, but many traders and investors also use Monthly, or even intraday charts.

- Shorter term traders tend to use a smaller number of bars to calculate the MA.

- Longer term investors tend to use a larger number of bars to calculate the MA.

- Fine tune by adjusting the number of bars - experiment with it.

- Increasing the number of bars can make the MA slower and give delayed signals.

- EMA and WMA gives more importance to recent share prices.

- MA can be used as a buy/sell signal.

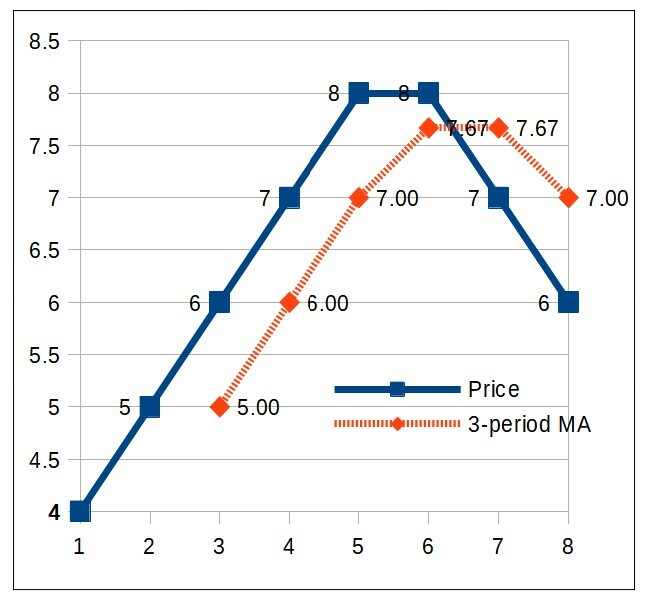

Exactly what is the Moving Average? – The simple graphic below indicates how the 3 “bar” Simple MA (for example) is the average of the prices for the last 3 price bars (ignores non-trading days – weekends, holidays).

|  | Moving Average buy/sell signals – Under some circumstances, the following ideas can be used to assist with buy or sell signals:.

- Buy when the share price action is above, and stays above, a MA line.

- Sell when the share price action falls below a MA line.

But, this raises some questions, such as:

- Which moving average type should we use? (ie. Simple, Exponential, Weighted, etc.).

- Which period should we use? (ie. 13 period, 21, 24, 30, 32, etc.)?

This is your call, and you need to experiment.

MMA – Multiple Moving Average – There can be a number of advantages to adding a Multiple Moving Average (MMA) indicator to a price chart. It can help to provide greater insight into the market mood and sentiment, as well as the presence and strength of any trend.

Any point on the chart where several of the MA curves come together is considered a very bullish signal in upward moves (as in the price chart below), and bearish on downward moves.

Also, the Moving Average Cross-over is a special variation utilising just two moving averages, and can be used to give buy and sell signals. |  |

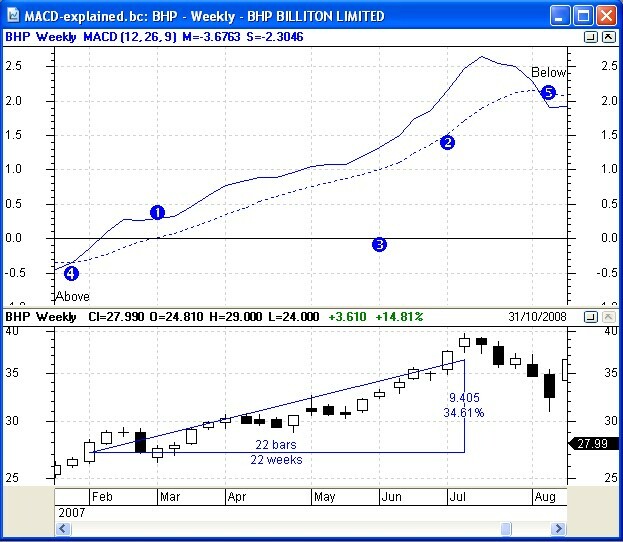

MACD — Moving Average Convergence Divergence – A trend-following lagging indicator, the MACD is rather popular. It was developed by Gerald Appel, and is useful in trending markets, not ranging markets. Note that some people consider the MACD a momentum indicator (oscillator).

The MACD indicator is basically a special combination of two moving averages. It comprises two lines that appear to be moving averages (in reality they are).

Note the following with reference to the numbers in the screen shot below of the Weekly chart of BHP, where the MACD is shown in the upper pane of the chart, and the share price candles in the lower pane. |  |

- The MACD vertical axis is actually in dollars and cents.

- The zero line (marked as 3) across the middle of the chart about which the indicator oscillates.

- Fast MACD Line — Often just referred to as the MACD line, it is the solid line marked as (1) in the figure above and is actually derived from two exponential moving average values (typically 12 and 26 periods) - it is the difference between them. Because the difference between these two moving averages is sometimes positive and sometimes negative, this indicator oscillates above and below the zero line.

- Signal (or trigger) Line — The line marked as (2) is itself an exponential moving average of the fast line (usually a 9 period moving average).

- The “Above” label — a potential buy signal — where the fast line crosses to Above the signal line.

- The “Below” label — a potential sell signal — where the fast line crosses to Below the signal line.

- The MACD Histogram can be added to the MACD pane of the chart (not shown here).

- Note in the lower price pane that in the uptrending stock shown, there was a price increase of some 34% in 22 weeks.

There are a number of potential trading signals with the MACD, but yo need to do some research for the details.

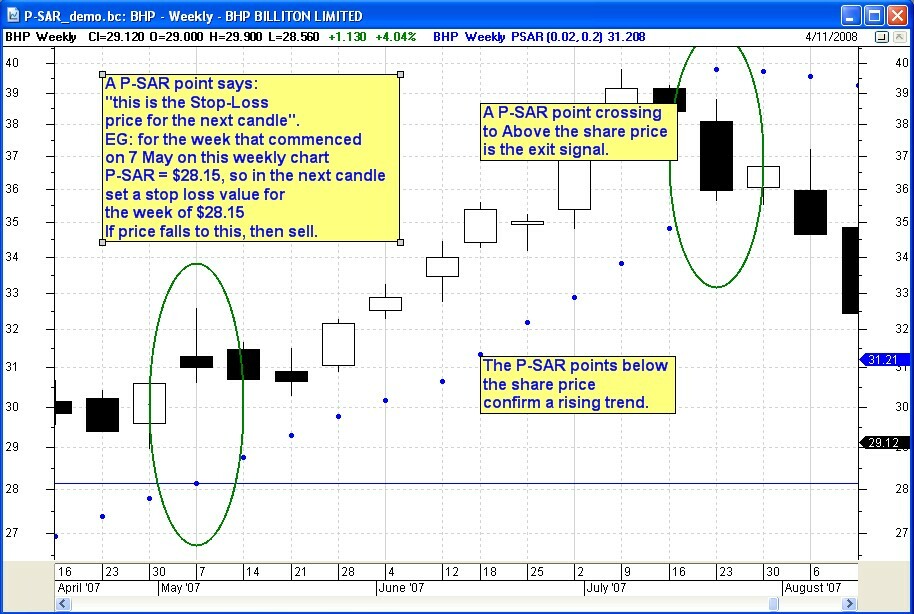

Parabolic SAR (P-SAR) – The Parabolic SAR (Stop And Reverse) indicator was developed by J. Welles Wilder and is used to indicate the Stop-Loss price point for tomorrow's trading. With reference to the price chart, note the following:

- The P-SAR dots are placed on the chart either below or above each candle.

- For most of the chart portion displayed here, the P-SAR are positioned below the candles. This confirms the up trend.

- As the stock rises from candle to candle, the next P-SAR value usually rises also.

- At a point of price weakness (eg. 23 July), the P-SAR has crossed to above the share price for that week.

- On this weekly chart, for the week of trading from 7 to 11 May 2007, the P-SAR point is below the candle at the value of $28.15.

- This P-SAR point says: “if the price falls to $28.15 any time next week, then sell.

- P-SAR could be considered for use for entry as well. When the P-SAR has crossed from above the price to below, this confirms the possible entry.

|  |

More technical analysis – In addition to the above material, there are additional topics that are often included in technical analysis material, including the following:

- Quantitative analysis

- Cycle Analysis

- Fibonacci (ratios, extensions and retracements)

- Elliott Wave analysis

- Gann studies (of price and time).

However, there is no more information about these in this article. The reader is encouraged to do some research if interested.

Other useful indicators – In addition, there are many other useful and popular indicators including:

- ADX/DMI

- Bollinger Bands

- ATR (Average True Range)

- Momentum

- On Balance Volume (OBV)

- Relative Strength Index (RSI)

- Money Flow, and several variations of it

- Price Rate of Change (ROC)

- Stochastics

- Volume Rate of Change

And one more feature that is useful to explore is the notion of bullish or bearish divergence. Do a Google search for more details.

Summary – This article, along with Part 1 in the June edition of the Blast! is a high level overview of most of the subject of technical analysis. Readers are encouraged to research the topic further. There is a vast amount of information published, and in the ATAA Resource Library.

|

Happy and safe investing/trading

Robert Brain | ATAA Member Perks and Benefits

| If you're not an ATAA member, and you are considering joining, you might be interested to know there are many good reasons to sign-up, including:

- Learn how to protect your hard-earned capital - using wise stock selection, and money and risk management ideas;

- Invaluable education opportunities (with discounts for members);

- Huge and extensive Resource Library (access for members);

- Networking opportunities - meet with like-minded peers for trading and investing discussions;

- Special Interest Groups (SIGs) (only for members) - there are several;

- News and information;

- Online Forums;

- Annual ATAA Conference (discounted for members).

| In Closing

As I said at the top, my apologies continue for any odd formatting that you might find herein - font size or line spacing, etc - but these seem to be oddities in our CE email editor which are very elusive.

I do hope you have found this edition of the Blast! Monthly News both interesting and useful. Feel free to send my any feedback - good or bad.

Robert B. Brain

Blast! Newsletter Editor

| |